Do not carry net statutory income to Schedule SE. Fully exempted Meal allowances.

Step 3 Your Home Supportive Mortgage Lender

Quick Reference As might be expected from the taxing statute the Tax Earnings and Pensions Act 2003 provides a very wide meaning of the employment income thats susceptible to tax under that statute.

. Appointment of a postholding office Remuneration is given to servant for such service renderedEmployment income is assessable underSection 4b of Income Tax Act. If workers are independent contractors under the common law rules such workers may nevertheless be treated as employees by statute statutory employees for certain employment tax purposes if they fall within any one of the following four categories and meet the three conditions described under Social Security and Medicare taxes below. Exemption available up to RM2400 per annum Parking fees allowances.

Form 1099 is given to independent contractors. The statutory employee can deduct on Schedule C their trade or business expenses from the earnings shown on Form W-2. What is statutory income in income tax.

Employers send statutory employees W-2s instead of 1099-MISCs. Income of Preceding Years Not Declared 22 Part H. An individual must meet certain criteria to be considered a statutory employee.

Legally statutory employees are considered internal employees. Your normal weekly fortnightly or. 15666 or 90 of the employees average weekly earnings whichever is lower.

This is where you key in the total amount of what you earn from your employer. Statutory employees can also deduct work-related expenses on Schedule C when they file their annual tax returns. Salary and wage payments you need to declare in your tax return include.

Statutory income from interest discounts royalties premiums pensions annuities other periodical payments other gains or profits. Statutory Adoption Pay weekly rate for remaining weeks. TOPIC 3EMPLOYMENT INCOME31IntroductionEmployment income defined in Section 2 of Income Tax Act 1967 is when therelationship between masteremployer and servantemployee exist which.

Income Reported on a Statutory Employee W-2. The employer provides the statutory employee with a Form W-2 that shows the amount of payments to the person as other compensation in box 1. What does statutory income include.

What is a statutory employee W-2. Total amount paid by employer. The most common type of employment income is salary and wages whether you have one job or more are full-time part-time or casual.

You are also required to declare any non-salary related benefits that can count as. Total amount paid by employer. Statutory Income is also reffered to as Take Home Pay as it is the amount of money you take home after all deductions.

Do not combine statutory employee income with self-employment income. Aggregate income Statutory income from all businesses and partnerships business loss brought forward Statutory income from employment rents. However theres one difference.

Statutory employees receive the same W2 form as all other internal employees. Fully exempted Interest on loan subsidies. Instead file a separate Schedule C for each type of income.

Social Security and Medicare wages and withholding are included in the usual boxes. Particulars of Executor of the Deceased Persons Estate 22 Declaration 23 Particulars of Tax Agent who Completes this Return Form 23 Reminder 23 Part 2 Working Sheets HK-2 Computation of Statutory Income from Employment 24 HK-21 Receipts under Paragraph 131a 26. Statutory income from rents.

Under statutory income fill out all the money you earned from employment rents and other sources. Examples of statutory income include capital gains dividends and franking credits any allowances and redundancy payments see section 105 of the Income Tax Assessment Act 1997 Cth. Total amount paid by employer.

This may be cash-in-hand payments directly into your bank account or in another way. Statutory income from employment. With effect from the year 2015 an individual who earns an annual employment income of RM34000 after EPF deduction has to register a tax file.

These are the types of income that are taxable. That difference is that. The Statutory Employee option must be checked in Box 13.

Around tax season your employer should have provided you with an EA Form with an amount listed which youll have to key into the field titled statutory income from employment. You should get this figure from the EA Form that your employer prepared for you. This is where your EA form comes into play as it states your annual income earned from your employer.

Therefore at the end of the tax year you receive a W2 form instead of a 1099-MISC form. However there are several reasons why you shouldnt merely accept the annual income stated on your EA form as the final figure for your statutory income from employment. Employment earnings printed on by null.

Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the Income Tax Act. Loans totalling RM300000 for housing passenger motor vehicles and education Income tax borne by employer. In other words those who earn a minimum salary of about RM3000 a month should file their income tax.

Employment earnings means any salary wages or fee gratuity other profit or incidental. A statutory employee is an independent contractor who is considered an employee for tax withholding purposes.

Printable Sample Employment Contract Sample Form Contract Template Free Basic Templates Employment

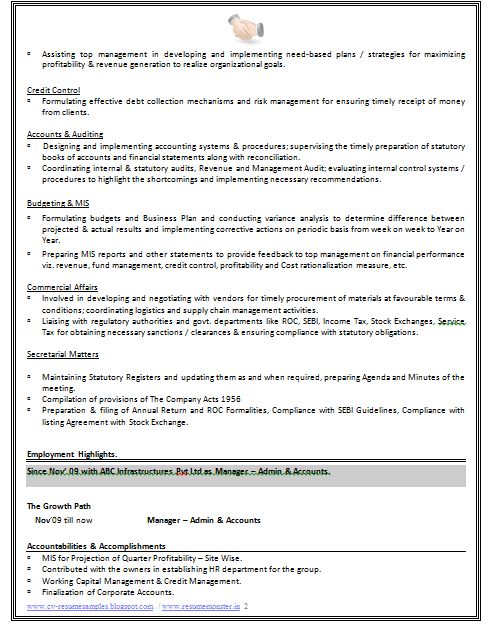

Good Cv Resume Sample For Experienced Chartered Accountant 2 Cv Resume Sample Accountant Resume Good Cv

Company Policy Template Template Business

Accountant Resume 2 Accountant Resume Risk Management Resume

Mortgage Underwriters Meaning Useful Factors Outcomes And More Underwriting Accounting Principles Mortgage

The Amusing 30 Gallery Ideas Of Job Application Templates For Microsoft For Employment Applicatio Job Application Template Word Template Employment Application

Tax Calculation Spreadsheet Excel Formula Spreadsheet Spreadsheet Template

Hr Generalist Training In Noida Human Resources Jobs Human Resources Career Human Resources

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Replica Document Templates Replacement Statements Bills

1040 2020 Internal Revenue Service Tax Forms Irs Tax Forms Standard Deduction

Proof Of Employment Form Employment Form Letter Template Word Letter Form

Iict Networkingtraining Hardware Iict Is The No 1 Hardware And Networking Training Institute In Chennai Desktop Support Training Center Supportive

Resume Format India Resume Templates

Hr Recruitment Manager Resume How To Draft A Hr Recruitment Manager Resume Download This Hr Recruitment Mana Manager Resume Resume Templates Download Resume

Pin By Weivy Beiby On My Saves Security Tips How To Plan Employment

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes